Let’s take a look at the Boston Institute of Finance’s certified financial planner course in our comprehensive review. Is it worth taking? Becoming a certified financial planner isn’t easy. It’s intentionally hard, and it’s easy to see why. But it doesn’t have to be impossible for those of us who want to actually put the work in.

Consider this: only about 35% of Americans actually use a financial advisor, and yet those who do often report significantly greater confidence in their financial futures. That gap underscores both the unmet need for guidance and the potential impact of quality training.

That’s where the Boston Institute of Finance’s certified financial planner course comes in. A trusted option that’s been around for decades, countless successful planners credit it for getting them across the finish line. But is it actually worth the price, and does it deliver on what BIF claims? Let’s take a deep dive into the Boston Institute of Finance’s CFP® Review course.

Who Could Benefit From the BIF CFP® Course

- If a structured approach to preparing for your certified financial planner course is what you’re looking for, then this can be a great pick.

- If visual learning makes studying easier for you, then the BIF CFP® course has everything you need.

- If you want to take your time learning and getting ready, the course’s 21-month access gives you the time you need.

- If you prefer either a live or self-paced approach – and not an in-person one – then this could be one of the better options for you.

- If you want a bit of a one-on-one approach, then BIF’s Q-and-A’s and live forums make this a recommended pick.

Boston Institute of Finance CFP® Review: Covering the Basics

Over the past 20 years, the Boston Institute of Finance has built a reputation for being a budget-friendly way to prepare for the Certified Financial Planner exam. After having spent time on the course, I can see why.

It’s one of the more affordable options to go with. But, low cost doesn’t always have to mean low quality. BIF is a great example of that. One of the lower-cost options out there, it offers some of the best course materials, a lot of hands-on support, and an excellent approach to exam prep.

I spent quite a bit of time going through the coursework, study materials, and the (almost excessive number of) videos and other aids.

These aids extend well beyond just the typical pre-recorded videos; there are plenty of live classes and instructor-led support to take advantage of. Add in a 21-month access period, and you’ll have plenty of time to get through everything.

Pros

- The student community is quite active, especially on the forum, and offers some extra help.

- Plenty of live weekly classes to join and take part in whenever you want to.

- The instructor-led packages offer genuine support and help when you need it.

- Plenty of exam prep sessions to take part in, which offer exam tips, question walkthroughs, and other assistance.

- Has a 21-month access period, so you can avoid rushing through trying to prepare.

Cons

- Only offers either a self-paced or online approach, which can be a drawback for anyone who wants in-person help.

Boston Institute of Finance

Boston Institute of Finance CFP® Packages

| Features | Instructor-Led + Premium Review | Instructor-Led + Core Review | Self-Paced Ed + Premium Review | Self-Paced Ed + Core Review |

|---|---|---|---|---|

| Price | $5,790 | $4,990 | $4,790 | $3,990 |

| 7 CFP® Courses | ||||

| 3 Digital Reference Books | ||||

| 8-Week Live Class Schedule | ||||

| 3 Question Banks | ||||

| Instructor-Driven Cohort | ||||

| Premium BIF Review Retake | ||||

| Live “Testable Topic” Tuesday Classes | ||||

| Live “Question Breakdown” Thursday Classes | ||||

| Formula and Case Study Tips | ||||

| Community Forum Access | ||||

| 21-Month Access Period | ||||

| Learn More | START NOW | START NOW | START NOW | START NOW |

There’s no such thing as a one-size-fits-all approach when it comes to studying. We’re all a little different and need somewhat different approaches to our learning style. Thankfully, BIF keeps that in mind with their CFP® packages.

Each of these boasts its pros and cons. Let’s dig into what they actually offer.

Self-Paced Education + Premium Review

This package is one of the better options if you don’t have a consistent amount of time to dedicate to preparing for the CFP® exam, but still want to fit some work in. It offers quite a few features, study materials, and aids to get you going.

These are the main benefits of this package, aside from taking it at your own pace. The JAM sessions and deep dives are what really make this one stand out, though. As long as you’re putting the work in, there’s no reason why you shouldn’t be as prepared as possible.

Self-Paced Education + Core Review

If you’re looking for one of the more budget-friendly options, but still need a bit of help, this is one of the more appealing options. There are lower-cost options (like the self-paced only), but these come with far fewer options. The Core Review side of things gives you everything you need.

The targeted QBanks and deep-dive sessions are what stood out to me here. I don’t see a reason why they shouldn’t help you. Like most other self-paced options, though, you’ll need to actually put the time investment into it.

Self-Paced Only

Speaking of budget-friendly options, the Self-Paced Only package is definitely the most affordable one from BIF. If you’re worried about cost or just don’t need many extras, this can be one of the better picks to go for. I’m not too big a fan, but to each their own.

If you’re able to put in the effort consistently with this, there’s no reason why this can’t be a decent bit. For the difference in cost, though, I’d rather go for some of the other options. There’s a lot more included, and this can be quite helpful.

Instructor-Led Education + Premium Review

And now, onto the opposite end of the spectrum. The Instructor-Led Education + Premium Review is the most expensive option on offer. But the materials it packs in make it more than worth it. It packs in everything you’ll need, boasting quite a bit of value.

One of the main benefits I saw with this was the 170-question mock exam. While there’s more on offer, this mock exam perfectly simulates the actual test. This helps – for me, at least – to get into the right mindset once the proper exam comes around.

Instructor-Led Education + Core Review

This option offers the best of both worlds when it comes to the Instructor-Led and Self-Paced packages. It gives you enough of the more expensive package to make it worth it, without it costing too much if you’re on a budget.

That means making a few sacrifices compared to the instructor-led education and premium review package, but there’s still enough to make sure you’re as prepared as possible.

Instructor-Led Only

If you don’t want too many frills but still need some hands-on help, then the Instructor-Led only option could be the best option to go for. This offers a structured approach for anyone who needs it, but without the additional features you’ll find in either of the other Instructor-Led packages.

Like the Self-Paced Only option, this offers a certain amount of freedom and help, without needing to spend too much on it. As long as it suits your learning style and you don’t need too much help, it can be a great budget-friendly pick.

Save on these courses with a verified Boston Institute of Finance coupon code.

BIF Certified Financial Planner Review: Diving a Little Deeper

Now we’ve got the basics out of the way, it’s worth diving a bit more into the Boston Institute of Finance’s certified financial planner course. Let’s break it up into a few areas to make sure we’ve covered everything you’ll need to know to make your decision.

My Personal Experience

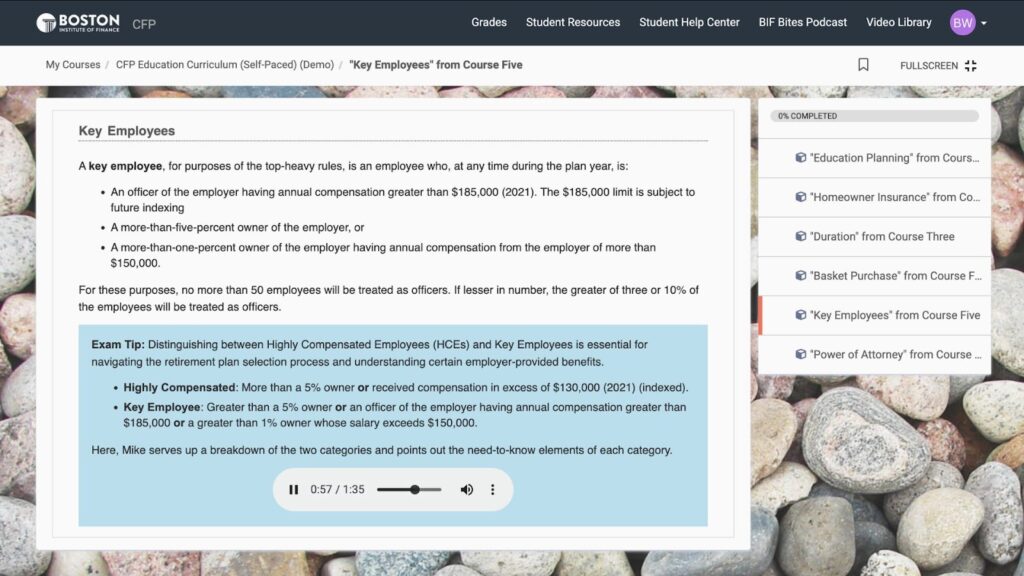

I’ll be honest; I felt a little overwhelmed logging into the BIF CFP® site for the first time. However, a lot of that was due to the sheer number of options available. After a few minutes looking around and checking the materials out, it felt a whole lot less overwhelming.

It just takes a little getting used to. Once I was, though, everything was a breeze. I was able to quickly and easily dive into everything I needed. This was helped by how easy-to-navigate the platform is, and the fact that everything’s clearly visible.

As long as you’re able to overcome that initial mental block – at least, those of us who get it – there’s no reason why this shouldn’t be an easy platform to dive into.

The prep work and study materials were all better than I would’ve thought, though I shouldn’t be surprised. One of the main areas that stood out to me was the Bonus Tools. While these are only available for packages with Core Review included, they’re worth considering.

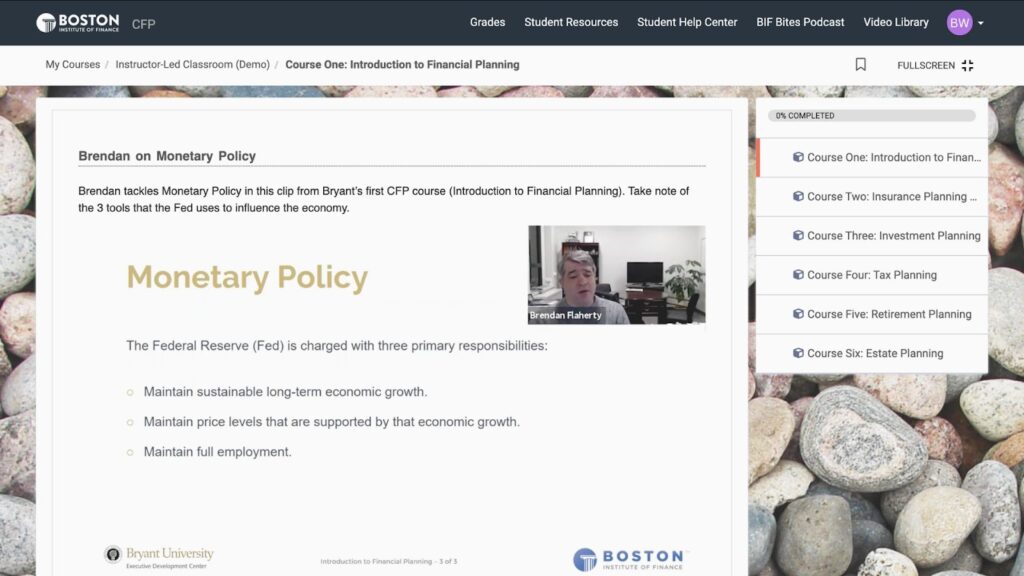

Videos and Virtual Classroom

There are plenty of videos to take advantage of with the BIF CFP® course, regardless of the package you go for. The only real difference is how many of these you’ll have access to, and whether they’re live or not. Either way, these are well-designed, properly paced, and high-quality.

The live classes themselves are more than worth investing in. You’ll get plenty of these with most packages, though you’ll get more of them with some of the higher-priced options. I was pleasantly surprised by how well the videos—and the overall virtual classroom—explained everything one would need to know.

Value for Money

Cost is a natural part of picking a certified financial planner course. It’s financially planning out your journey, after all. While some of BIF’s options seem expensive, they cram in quite a few study materials and other aids. For my buck, it’s more than worth what it costs.

The more affordable packages that the Boston Institute of Finance offers can seem more appealing. But this depends on your situation. If you need extra help and support, even the higher-priced options offer a lot of value.

I do love that they stand behind their program with a 100% satisfaction money-back guarantee; you have 15 days from purchase to request a refund, no questions asked. On top of that, BIF lets you try before you buy with a 30-day free demo of their CFP® Review course. This gives you hands-on access to their study modules, question banks, and platform interface before committing.

Support and What Students Have to Say

All of us need a bit of support with our prep work, even when we’re just going for the Self-Paced Only package. Thankfully, BIF offers this through:

- An online chat

- Over-the-phone

- Live sessions with instructors

I came across several success stories, but one in particular stood out to me. A student on the accelerated path who passed on their first attempt after following BIF’s plan to the letter. They described working through all question bank items, rewatching jam sessions during the final week, and even streaming BIF’s podcast content while at the gym.

It wasn’t just about memorizing material. They emphasized how BIF helped them understand the bigger picture and “know the flow,” which gave them the confidence they needed on test day. Even when outside quizzes rattled their nerves, they found the BIF prep much more aligned with the actual exam. This is real student support.

Another standout resource? BIF Bites, a free podcast from the Boston Institute of Finance. These short, snack-sized episodes tackle tough exam topics in under 10 minutes.

You can see that the Boston Institute of Finance offers plenty across categories despite fewer bonus tools and no onsite classes. Next, let’s compare BIF’s value to that of top competitors Kaplan and Dalton.

“Loved their live review, 3 hours on 8 Mondays in a row. You can ask live questions and they answer them all live in the chat for you. The instructors are incredibly helpful. Haven’t taken the exam yet but feeling prepared.”

KittenMcNugget123, Reddit

CFP® Courses Compared to Boston Institute of Finance

| Feature | BIF | Kaplan | Dalton |

|---|---|---|---|

| Price Range | $3,990 to $5,790 | $5,350 to $8,049 | $5,995 to $8,495 |

| Study Style | Structured 8-week plan | Flexible, choose-your-own format | Traditional classroom style |

| Live Classes | 2–3 per week | Yes, optional | Yes, many options |

| Practice Questions | 1,500+ | 2,500+ | 2,800+ |

| Best For | Students who like a clear learning path | Students who want options and tools | Students who want more live interaction |

Boston Institute of Finance vs. Kaplan

Kaplan is another one of the leading names in the certified financial planner prep world. I can see why, as it offers a lot of study tools and materials. You should have everything you need to get ready for the exam. It’s one of the better options if you want a bit of freedom and to take your time with it.

But, BIF can be a better option if you’d prefer a more hands-on and instructor-led approach to studying. It’s a lot more focused, helping you hone in on any areas you actually need to work on.

If you want a more hands-off approach, go with Kaplan.

BIF is the better option when it comes to getting extra support and help, though.

Boston Institute of Finance vs. Dalton

Dalton can be a great approach to certified financial planning prep work, but this depends on your learning style. This has more of a classroom vibe, with a lot of live instruction and quite a bit of hands-on support. If you want your hand held during your prep work, this is a great pick. But you’ll be paying quite a bit for it.

The Boston Institute of Finance has more of an updated feel and doesn’t feel like you’re still a child in school. There’s nothing wrong with either approach, depending on your learning style. But BIF feels like it takes a more personalized approach without feeling like you’re being talked down to.

Check out my best CFP® prep course comparison to see how these review courses rank and save with a CFP® promo code.

Final Verdict

There’s a reason why the Boston Institute of Finance’s certified financial planner course is so well-known and trusted; it actually does what it says it’ll do. Based on my experience, it’s a great way to prepare for the actual exam, and there’s no reason why learners shouldn’t be ready for it.

No matter what your learning style is, there’s a package for you. For my money, it’s definitely worth investing in. It isn’t the most comprehensive option out there, but it packs a punch for how affordable it is. The value for money, usability, and features all make it more than worth it. I don’t see a reason why the BIF-certified financial planner course shouldn’t help you get ready for the actual exam.

FAQs

You get over 1,500 exam-quality practice questions plus a 170-question mock exam to really test your skills.

The Premium Review package includes one free retake if you don’t pass on your first try.

BIF’s CFP® program is known for its active online student community—great for asking questions, finding study buddies, and getting extra help.

With flexible self-paced and instructor-led options (as well as recorded live classes), you can fit studying around your life.

BIF’s classes focus on exam strategies and format, so you’ll feel confident walking into exam day.