For risk professionals looking to advance their careers, the Financial Risk Manager (FRM®) designation is one of the most respected credentials in the field, with over 112,000 designation earners in 150 regions and countries around the globe.

But before you can add those three letters to your name, you’ll need to pass two tough exams. And if you’ve heard that the FRM® exam difficulty is no joke, you heard right.

Pass rates for the program consistently prove just how rigorous the process is. Let’s dig into the latest numbers, what they mean for FRM® candidates, and how to approach the exam with the best shot at success.

Key Takeaways

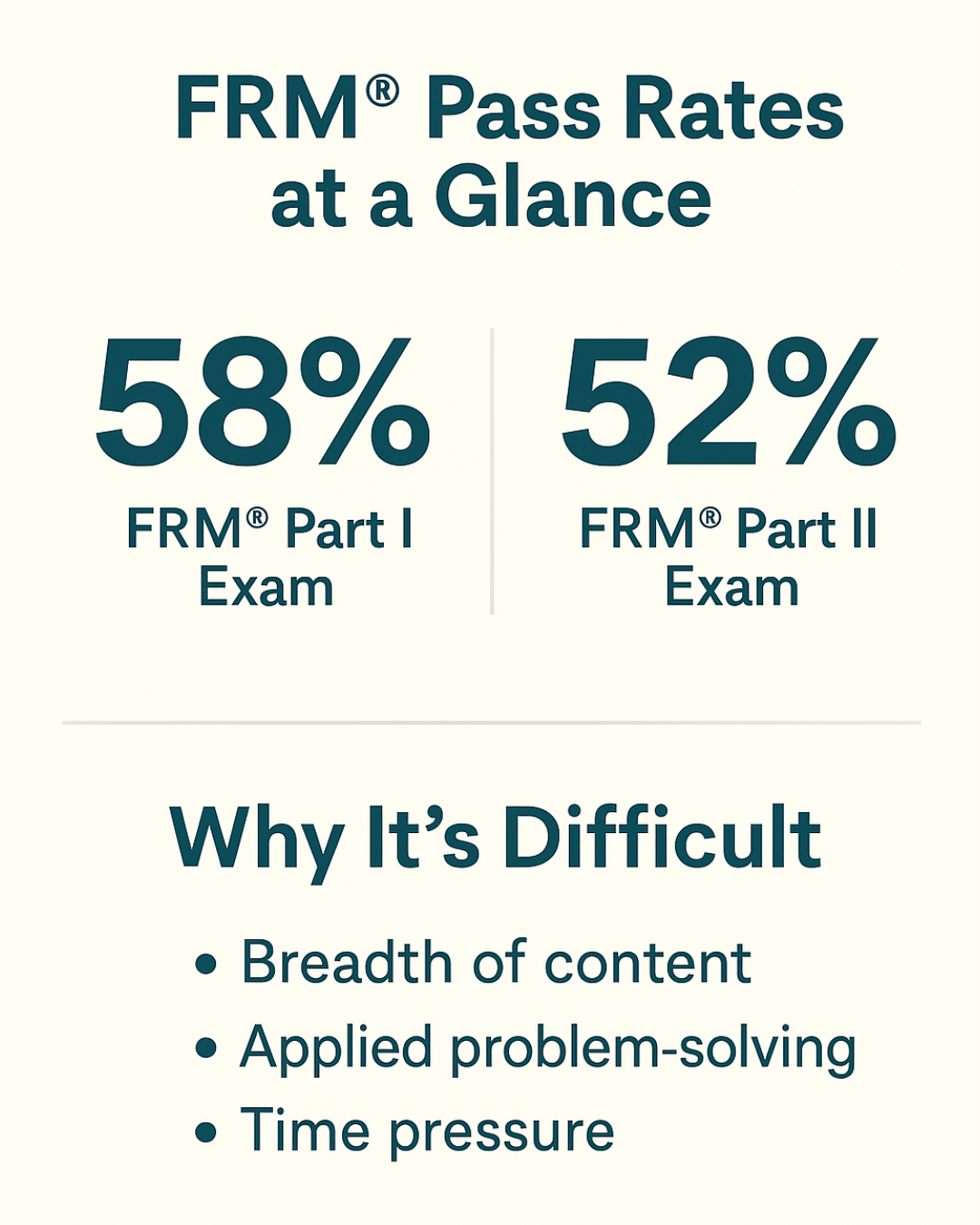

- Latest Results: In May/August 2025, the FRM® Part I exam had a 58% pass rate, while FRM® Part II came in at 52%.

- Why It’s Tough: Breadth of content, applied problem-solving, and time pressure make the FRM® exam difficulty exceptionally high.

- Part I vs. Part II: Part I focuses on foundations like quantitative analysis and valuation and risk models, while Part II emphasizes applied risk.

- Prep Is Key: Success depends on a structured study plan, steady practice, and completing full-length mock exams.

- Credential Value: The relatively low pass rates preserve the prestige of being a certified financial risk manager worldwide.

FRM® Pass Rates: The Latest Data

The FRM® exam is split into two parts, and both are known for their challenging design and comprehensive coverage. In the May/August 2025 testing windows, the results looked like this:

- FRM® Part I Exam Pass Rate: 58%

- FRM® Part II Exam Pass Rate: 52%

That means nearly half of all candidates don’t make it through on their first try. And it’s not because they’re unqualified—the FRM® attracts experienced finance professionals from investment management, banking, and risk-focused roles. The numbers reflect the reality: the exam demands serious preparation and focus.

Why the Pass Rates Are Relatively Low

So why does the average pass rate hover around 50–60%? It comes down to the breadth and depth of the content, as well as the exam structure itself.

- Complex Topics: Candidates must master a wide range of material, including valuation and risk models, quantitative analysis, and financial markets.

- Applied Focus: Part II emphasizes the application of tools from Part I, with heavy emphasis on market risk measurement, credit risk measurement, operational risk, and treasury risk measurement.

- Time Pressure: On exam day, you’re faced with 100 multiple-choice questions in Part I and 80 in Part II, each requiring careful analysis and often multiple steps.

- Minimum Passing Score: GARP doesn’t publish a fixed cutoff, but it sets a minimum passing score based on overall performance each cycle. That means the bar moves slightly, and candidates can’t rely on just hitting a specific number—they need to be comfortably above average.

FRM® Part I vs. Part II Pass Rates

The drop from 58% in Part I to 52% in Part II is worth discussing, as typically, pass rates tend to increase in each section for other exams. The logic behind this is that if you pass the first level, you know what it takes to pass, and you can replicate that experience. Here’s why it might be different for the FRM®:

- Part I Exam: Tests foundational knowledge—risk management, quantitative analysis, financial markets, and valuation and risk models. Many candidates underestimate this portion because it feels like “the basics.” But in reality, the mathematical intensity and breadth catch people off guard.

- Part II Exam: Applies those concepts in integrated case studies. You’ll see exam questions that combine credit risk, market risk, and operational risk in one scenario. For many, this applied problem-solving is harder than memorizing formulas, leading to lower pass rates.

How Pass Rates Compare to Other Certifications

Compared to other finance credentials, FRM® pass rates fall somewhere in the middle. They’re lower than many insurance licensing exams, but higher than the notoriously difficult CFA®, where some levels see pass rates below 40%.

This makes sense: the FRM® is highly technical but not quite as broad as the CFA®. Still, for risk management professionals, it’s just as valuable—especially given the global association (GARP) behind the program.

What the Pass Rates Mean for Candidates

The takeaway isn’t that the FRM® is impossible—it’s that you need a plan. A 58% or 52% pass rate means plenty of people do succeed. The difference often comes down to preparation.

Here’s what successful candidates tend to do differently:

- Build a Study Plan Early: Most candidates start at least four to six months before exam day, logging 200–300 hours of study time per part.

- Use Practice Exams: Simulating the real test environment helps with pacing and focus. It also makes you more confident with the format of FRM® exam questions.

- Drill Practice Questions: Working through question banks helps you see how concepts like risk measurement and management are tested in different ways.

- Focus on Weak Spots: If quantitative analysis isn’t your strong suit, spend extra time there. The exam won’t let you hide from weaker areas.

Strategies to Improve Your Odds

Given the FRM® exam difficulty, you’ll want to approach it strategically:

- Don’t Skip Mock Exams: They replicate timing pressure and help you manage fatigue across long sessions.

- Balance Breadth and Depth: Part I requires familiarity with a lot of topics, while Part II demands applied thinking. Don’t overfocus on one at the expense of the other.

- Leverage Official Materials: While third-party guides are useful, GARP’s official readings align directly with exam topics.

- Stay Consistent: Daily practice is better than cramming. The material is dense, and you’ll retain more with steady exposure.

FRM® Pass Rates in Perspective

While the numbers might look intimidating, it’s worth remembering why the FRM® maintains tough standards. The credential is meant to ensure that certified financial risk managers are ready to handle real-world complexity—from stress testing portfolios to analyzing credit risk exposures.

The relatively low FRM® exam pass rate also protects the value of the designation. Employers know that an FRM® didn’t just check a box—they demonstrated persistence, technical skill, and judgment under pressure.

Final Thoughts

The May/August 2025 results—58% for the FRM® Part I exam and 52% for the FRM® Part II exam—are proof that the road to certification isn’t easy. But that’s exactly what makes the FRM® credential so meaningful.

For FRM® candidates willing to commit to a structured study plan, lean on practice exams, and master topics like valuation and risk models, credit risk measurement, and market risk measurement, the reward is a globally respected designation that signals expertise in risk measurement and management.

So while the numbers may look daunting, the pass rate isn’t a reason to avoid the exam—it’s a reason to take preparation seriously.

FAQs

In May/August 2025, the pass rate was 58% for Part I and 52% for Part II, showing the program’s rigor and the importance of preparation.

Yes. The FRM® tests advanced topics in financial markets, credit risk, and operational risk, requiring both breadth of knowledge and applied judgment.

They’re difficult in different ways. The CFA® is broader across finance, while the FRM® dives deeper into risk. Many consider the CFA® harder overall, but both are challenging.

The average pass rate for the financial risk management exam typically hovers around 50–60%. That means nearly half of all candidates don’t pass on their first attempt.

The FRM® is very prestigious. Offered by the Global Association of Risk Professionals, the FRM® is globally recognized and highly respected among banks, investment firms, and regulators.