I didn’t start using buy now, pay later because I wanted “more stuff.” I started because I wanted to be able to have more cash in my account.

A lot of us have been in that spot where a purchase is necessary (or at least time-sensitive): a replacement charger before class, shoes for a new job, a laptop repair, or travel for a family event. And when the alternative is putting it on a credit card and letting interest climb higher by the day (often at an anxiety-inducing APR), BNPL can feel like a practical middle ground.

So, this is my Afterpay review: what it’s like to actually use the app, how the payments work in practice, what I like, what I don’t, and the situations where I’d recommend it (and where I definitely wouldn’t).

Key Takeaways

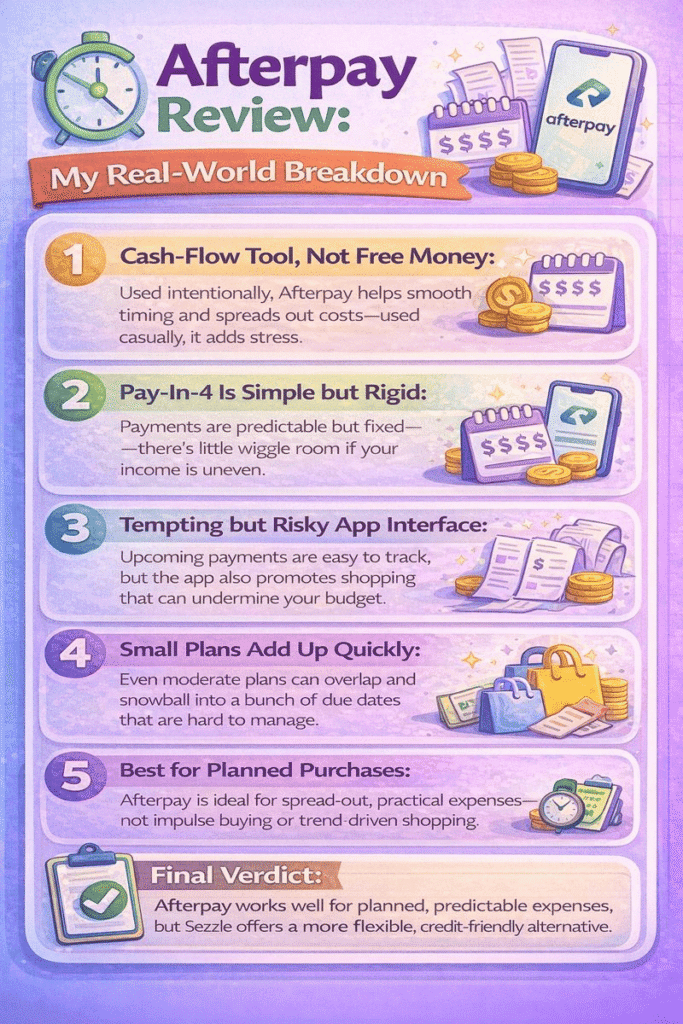

- Afterpay Is a Cash-Flow Tool, Not Free Money: Used intentionally, it helps smooth timing on purchases you could already afford—used casually, it adds stress.

- Pay‑in‑4 Is Simple but Rigid: The fixed schedule is great for predictability, but it leaves little room for surprises or uneven income.

- The App Is Both Helpful and Tempting: It clearly shows due dates and balances, but the built‑in shopping feed can quietly encourage impulse spending.

- Small Plans Can Add Up Quickly: Multiple BNPL plans running at once can turn into overlapping obligations that are harder to manage than expected.

- Best for Planned, Necessary Purchases: Afterpay works best for time‑sensitive essentials—not trend‑driven or “figure it out later” spending.

Afterpay Overview

Afterpay is a buy now, pay later (BNPL) service that lets you split a purchase into installment payments, most commonly the “pay in 4” plan. In plain English: you pay a portion upfront at checkout, then Afterpay automatically drafts the remaining payments on a schedule. If everything is paid on time under the standard plan, you typically won’t pay interest.

I’m framing this Afterpay review around the way most people actually encounter it: you’re checking out online, you see the Afterpay option next to your credit card and PayPal buttons, and you’re deciding whether it’s a smart move or a trap.

How Afterpay Works

Here’s the basic flow I experienced:

- Account setup: I created an account in the app, added my payment method (debit card/bank account options are common), and got an initial spending limit.

- Checkout experience: At many partner retailers, Afterpay shows up directly as a payment option. This is the primary function for non-Australian users.

- Payments: Typically, the first installment is due immediately, and the remaining installments are drafted automatically on set due dates.

That “set schedule” is the core of Afterpay. It can be great for predictability. But it can also feel rigid if your income timing is uneven (gig work, hourly shifts, or financial aid refunds that land on specific dates).

One thing I think people underestimate: BNPL doesn’t always replace credit card debt; it can sit on top of it. If you’re already juggling a card balance, multiple BNPL plans can turn into a pile of small commitments that all come due at slightly different times.

What I Liked About the Afterpay App

Afterpay’s app is straightforward when it comes to the essentials:

- It shows upcoming due dates and how much is scheduled.

- It allows early payments, which I like doing when I want to “clear the deck.”

- It sends reminders (useful, but I still recommend setting your own calendar alerts).

But the app also acts like a shopping feed. That’s not automatically bad, just… a little too convenient. If you’re using Afterpay because money is tight, the last thing you need is a parade of “deals” sitting next to your payment schedule.

Pros

Afterpay is popular for a reason. When it’s used intentionally, it can work well.

- Simple, interest‑free Pay in 4: As long as you pay on time, the total cost usually doesn’t increase, which is a clear advantage over carrying a credit card balance.

- Helpful for planned expenses: It works best for purchases you already expect, like replacing work essentials, buying course materials, or spacing out a pre‑budgeted travel cost.

- Fast and low‑friction checkout: Approval is quick, and splitting payments doesn’t require dealing with a bank or traditional loan.

- Debit and bank‑friendly: You don’t need a credit card, which appeals to people who want to avoid revolving credit.

- Wide retailer acceptance: Afterpay is supported by many major retailers, and the virtual card expands where you can use it. However, the main form of this is available to a limited group of Australians.

Cons

This is where things can get tricky, especially without careful use.

- Strict repayment schedule: Due dates are clear but not very flexible. A surprise expense can quickly lead to late fees or account restrictions.

- Unpredictable spending limits: Your available amount can change based on internal rules, purchase size, and past behavior, which can make larger or urgent purchases less reliable.

- Late fees add up across plans: One missed payment can snowball if you have multiple plans running at once.

- Limited human support: Most help is self‑serve or ticket‑based, which can be frustrating when you need quick resolution.

- Encourages impulse spending: The app is designed to promote shopping, which can work against better budgeting habits.

Quick Note on Afterpay Plus

You may come across references to Afterpay Plus, which is a separate, subscription-based feature that expands where Afterpay can be used. At the moment, Afterpay Plus is only available in Australia and is offered by invitation only to eligible existing users.

The main difference is access. Afterpay Plus provides an upgraded digital card that can be added to Apple Pay, Google Pay, or Samsung Pay, allowing users to use Afterpay at many places that don’t natively support it at checkout. In other words, it extends Afterpay beyond partner retailers.

For most users, though, this isn’t something you can sign up for directly; further, it’s not available in the U.S. right now. If you’re seeing mention of virtual card functionality elsewhere, that experience can differ by region and eligibility. For the majority of users, standard Afterpay still works primarily through supported retailers rather than as a universal payment card.

BNPL and Financial Wellness

If you’re using Afterpay while you’re job searching, in school, or juggling a career transition, BNPL can be either:

- a temporary bridge for necessities, or

- a quiet way to turn one big expense into four smaller stressors.

I’m a big believer that financial choices tie directly to career stability. If you’re working toward a new role or trying to stay afloat during training, it helps to have a plan that reduces surprises, not adds them.

To put this in context, I’ve seen solid guidance around personal finance and cash-flow realities discussed in professional money coverage like Accounting Today, as well as practitioner-focused commentary at CPA Practice Advisor and deeper analysis from outlets like The CPA Journal. Even though those sources often speak to finance professionals, the theme is consistent: predictable systems beat “hope it works out” systems, especially when payments are automated.

If you decide to use Afterpay, the most important “hack” isn’t a promo code. It’s setting up a structure so the due dates never surprise you.

Who Is Afterpay Best For?

Afterpay isn’t “good” or “bad” in a vacuum. It’s good for certain habits and budgets, and kind of dangerous for others.

Here’s who I think it fits best (and who should skip it), based on how it behaves in real life.

When Afterpay Makes Sense

Afterpay works best if:

- You want to split a planned purchase into four predictable payments.

- You use a debit card or bank account and want to avoid credit card interest.

- Your income is steady, your bills are on track, and you’re organized with due dates.

- You’re buying something practical and time-sensitive—like interview clothes, a transit pass, or work tech—and just want to space out the cost.

The key? You’d buy it anyway, and you could afford it in full today.

When Afterpay Isn’t the Solution

Afterpay might not be a good fit if:

- Your budget is already tight or irregular, and pre-scheduled payments could add pressure.

- You need more flexible repayment terms or have concerns about making payments on time.

- You tend to impulse shop or get swayed by “4 easy payments” messaging.

- You want immediate, live customer support when something goes wrong.

Quick Rule of Thumb

If you want a simple filter, this is mine:

- Would I still buy this if Afterpay didn’t exist? If no, I stop.

- Could I pay for it in full today without affecting rent/food/bills? If no, I stop.

- Will the payments land on dates that match my pay schedule? If no, I stop.

If all three are yes, Afterpay becomes a convenience, not a crutch.

Used that way, I think Afterpay is at its best: a tool for smoothing out timing on purchases you can already afford, rather than a way to reach for purchases you can’t.

Afterpay vs. Other BNPL Services

Buy now, pay later tools all share the same core promise: split your payments, skip the interest, and avoid long-term debt. But how each service delivers on that varies, especially when you compare Afterpay to competitors like Sezzle and Klarna.

Afterpay vs. Sezzle

Both Afterpay and Sezzle let you split purchases into four interest-free payments, and neither performs a hard credit check. But Sezzle goes further in a few important areas:

- Flexibility: Sezzle gives users one free reschedule per order, while Afterpay is stricter about payment deadlines.

- Credit Building: Sezzle offers an optional upgrade (Sezzle Up) that reports on-time payments to credit bureaus. Afterpay doesn’t offer credit reporting at all.

- Usability: With the Sezzle virtual card, you can shop at stores that don’t directly offer Sezzle at checkout, expanding your options beyond partner retailers.

If you’re looking for a little more control, visibility, and credit-building potential, between the two, Sezzle offers the better toolkit.

Afterpay vs. Klarna

Afterpay keeps things simple with its single Pay in 4 model and a clean, user-friendly app. Klarna offers more variety—including Pay in 30 and long-term financing—but some of its best features are gated behind a paid membership.

- Clarity vs. Complexity: Afterpay is easier to navigate, while Klarna’s tiered perks, variable “purchase power,” and changing fees can feel inconsistent.

- Credit Impact: Klarna can send unpaid balances to collections and reports to TransUnion in some cases. Afterpay is more forgiving, but also offers less in terms of financial growth or flexibility.

If you want to keep things basic and predictable, Afterpay wins. But for anyone needing more adaptable options or financial tools, Klarna (or Sezzle) might fit better.

Final Verdict

Afterpay isn’t inherently good or bad; it’s highly situational. When used for planned, necessary purchases and paired with steady income and strong organization, it can be a useful way to manage timing without paying credit card interest. But its strict repayment schedule, limited flexibility, and app-driven shopping cues mean it can quickly become stressful if your budget is tight or your income is unpredictable. Treated as a convenience tool rather than a spending shortcut, Afterpay does what it promises.

That said, for shoppers who want more flexibility, credit-building opportunities, and broader usability, Sezzle offers a more well-rounded alternative.

FAQs

In this Afterpay review, Afterpay is a buy now, pay later (BNPL) option that typically splits a purchase into four installments. You pay the first payment at checkout, then Afterpay automatically drafts the remaining payments on set due dates.

Afterpay is generally interest-free if you use the standard pay-in-4 plan and make every payment on time. The main added cost risk is late fees if you miss a due date.

This Afterpay review highlights that the app makes it easy to see upcoming due dates, pay early, and get reminders. The downside is that it also functions like a shopping feed, which can encourage impulse buys.

Afterpay spending limits can change based on factors like your payment history, the size of your cart, and internal risk rules that aren’t always transparent.

Afterpay can work well for planned, necessary purchases when you have a steady income and can handle fixed due dates. It’s riskier if your budget is already tight, your income is irregular, or you’re prone to impulse buying.

It depends on the lender’s policies and whether they report to credit bureaus. Some BNPL activity may not appear on your credit report, but missed payments can still lead to fees, account restrictions, and possible collections.